Navigating Amazon E-Commerce: Models, Strategies, and Success Factors

Summary

Amazon offers multiple e-commerce models—FBA, FBM, private label, arbitrage, and dropshipping—each with distinct logistics, costs, and scaling potential. Success relies on selecting the right model, managing operations, and monitoring key performance metrics to stay competitive.

Key insights:

Two Core Platforms: Amazon Retail (1P) and Amazon Marketplace (3P) define seller control and fulfillment responsibilities.

FBA Advantages: Sellers using FBA benefit from Prime access, automation, and global logistics support.

FBM Flexibility: FBM offers control and cost efficiency, ideal for unique or bulky inventory.

Private Label Potential: Branding and higher margins make private label a path to sustainable, long-term success.

Arbitrage & Dropshipping: These are low-barrier entry models but come with lower margins and scalability limits.

Operational Mastery: Strong inventory, financial, and marketing management is essential for profitability and growth.

Introduction

E-commerce is one of the most accessible yet competitive ways to build a business in the global digital economy. The platform allows thousands of independent sellers to reach a vast customer base without the need to create their own online store. This makes it an attractive entry point for new entrepreneurs and investors.

This insight will go over the operational models that exist within the platform to analyze how sellers generate a profit and look at the strategic choices that drive long-term success. At the end, this insight will help guide readers whether to pursue an FBA (Fulfillment by Amazon) business model, manage fulfillment independently through FBM (Fulfilled by Merchant), or develop a private label brand that leverages Amazon’s vast logistics network.

Overview

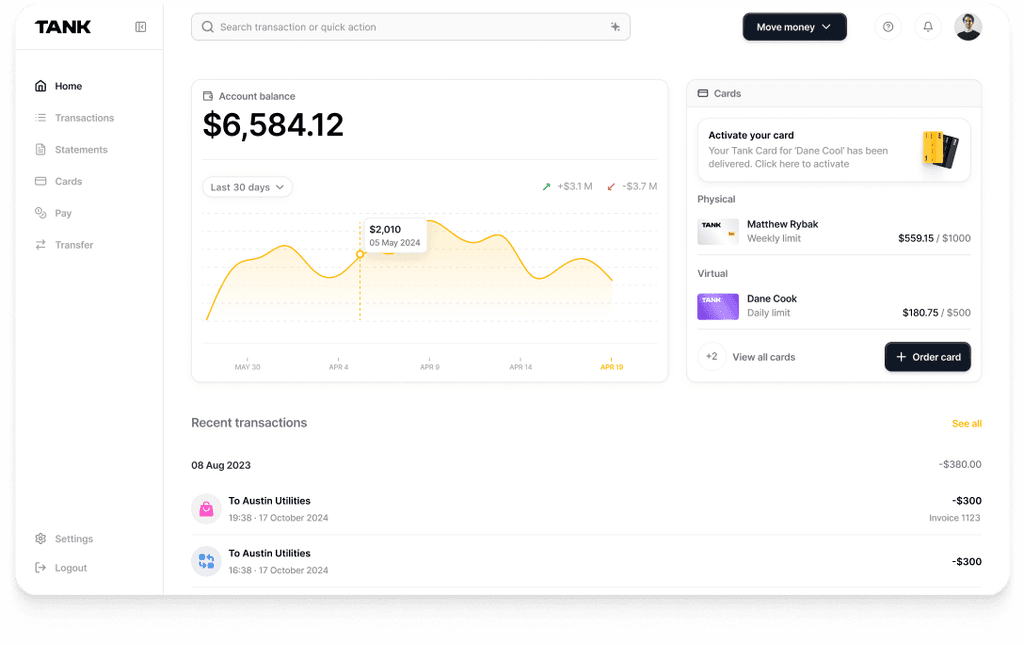

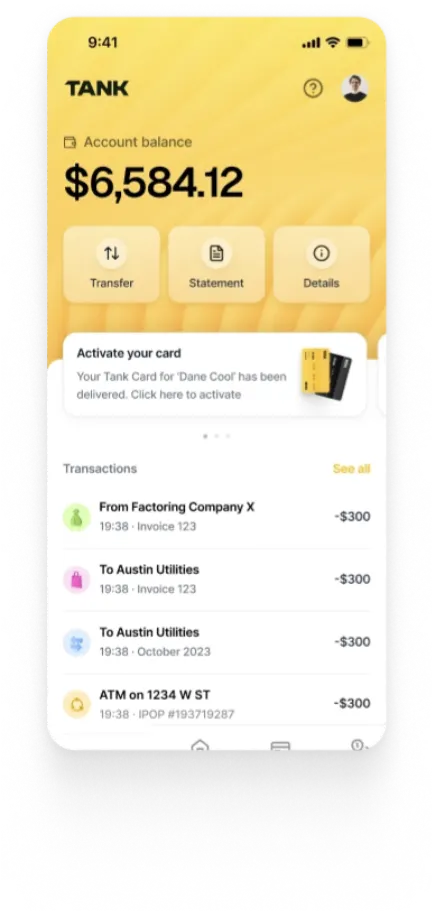

Amazon operates through two primary e-commerce models: Amazon Retail (1P) and the Amazon Marketplace (3P). In the 1P model, Amazon itself acts as the retailer. They purchase products directly from the brands or distributors and sell them to the customers under their “Sold by Amazon” label. This setup resembles a traditional wholesale arrangement, where the supplier’s role ends once Amazon buys their inventory.

In contrast, the 3P (third-party) marketplace allows independent sellers to list and sell products directly to customers on Amazon’s platform. These sellers maintain control over the pricing and branding of their products, and while they leverage Amazon’s platform, they are still responsible for their inventory management. Today, over 60% of Amazon’s retail sales come from 3P sellers, which shows the dominance and the flexibility of the marketplace model.

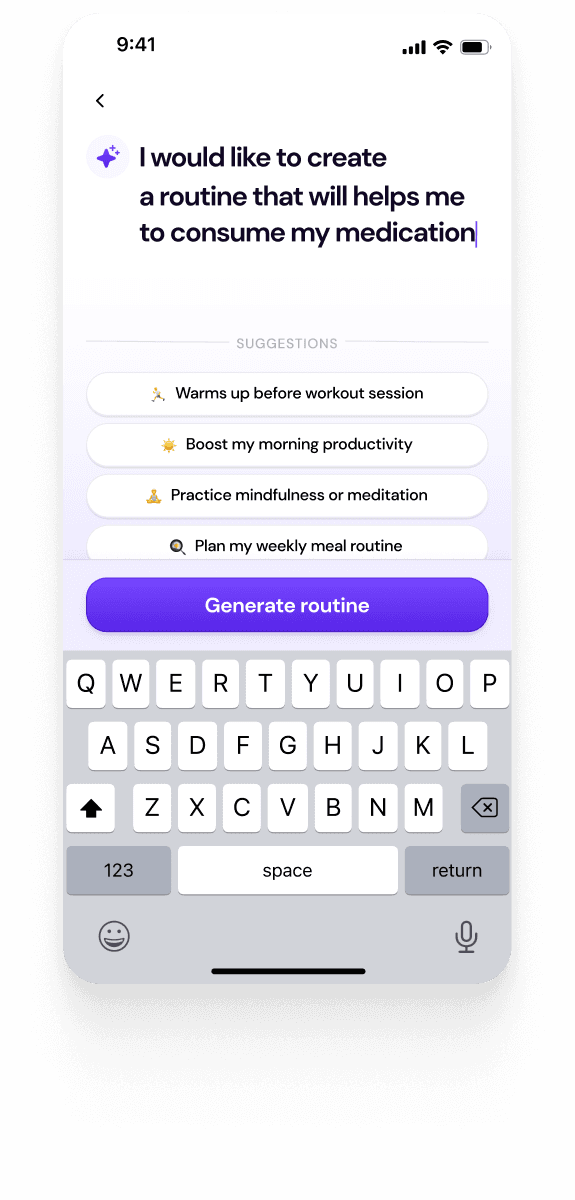

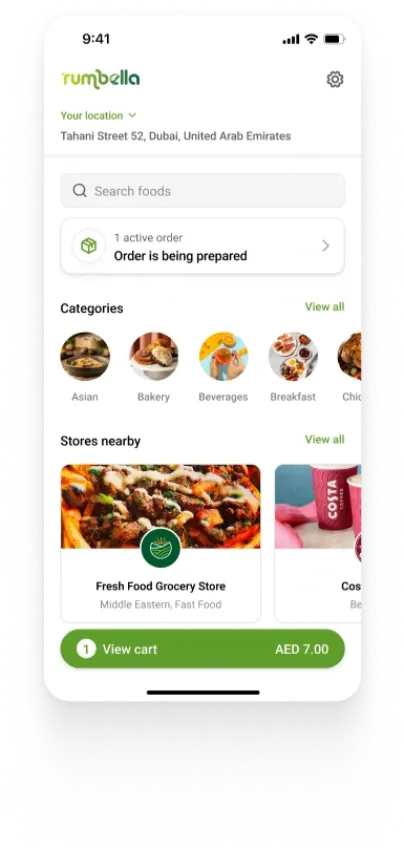

Individuals or brands can sell on Amazon through several approaches, depending on the goals and resources they have. Some operate as Private Label Sellers, who manufacture products through third parties and sell them under their own brand name to establish long-term equity and get higher margins. Others might choose wholesale or arbitrage models, buying branded goods in bulk or at discounted prices and reselling them for profit. Entry is hence relatively simple; sellers register for a professional or individual seller account, list products in existing categories, and decide whether to complete the orders themselves (FBM) or use Amazon’s storage and shipping network (FBA). The platform provides tools for analytics, advertising, and inventory tracking to make it accessible to both new entrepreneurs and established businesses.

The general e-commerce workflow on Amazon follows a consistent pattern. Sellers begin by sourcing inventory from suppliers, manufacturers, or distributors, ensuring product quality and competitive pricing. Next comes creating optimized product listings, complete with detailed descriptions, images, and keywords, to maximize the visibility of the products in the search results. Once sales start, fulfillment determines the delivery experience: through FBA, Amazon handles the storage, shipping, and returns; through FBM, the seller manages logistics independently. Marketing and advertising tools such as Sponsored Products, promotions, and reviews drive visibility and conversion. Finally, effective customer service, which includes fast responses, issue resolution, and maintaining high ratings, ensures account health, repeat purchases, and long-term success on the platform.

Business Models on Amazon

Amazon offers multiple business models that cater to different seller goals, investment levels, and operational capacities. Each model defines how the products are sourced, branded, and delivered to customers, which ends up shaping profit margins and scalability.

1. Fulfillment by Amazon (FBA)

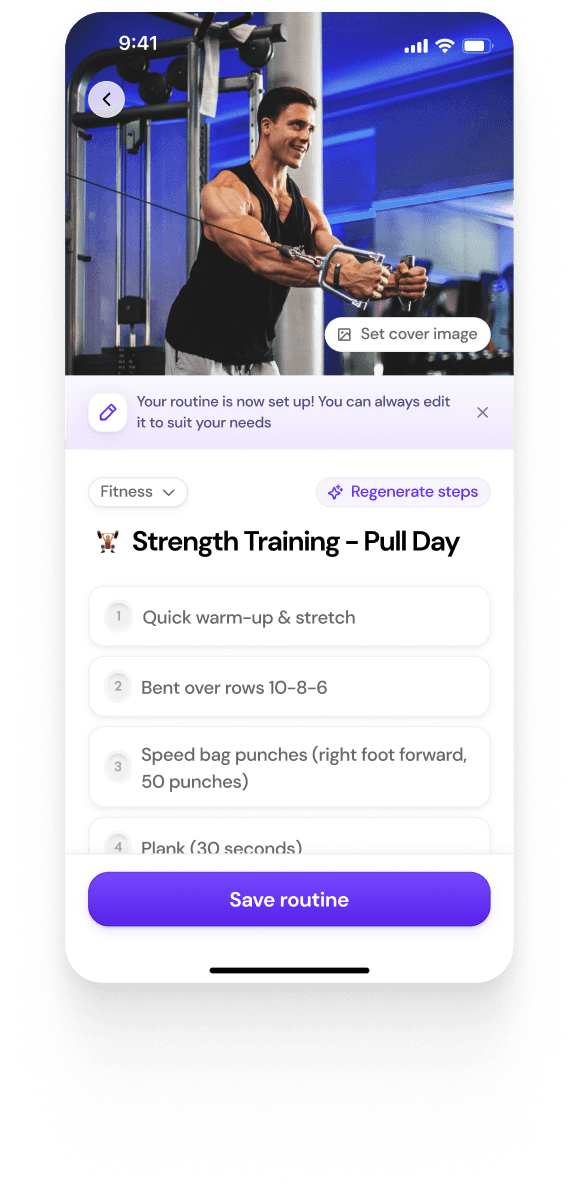

Fulfillment by Amazon (FBA) is a service that allows sellers to outsource order storage, packaging, shipping, returns, and customer service to Amazon. By enrolling products in FBA, sellers gain access to Amazon’s global fulfillment network, which provides faster delivery and Prime eligibility for customers. The system saves time and also helps sellers scale by leveraging Amazon’s logistics, customer trust, and automation through programs like Supply Chain by Amazon and Multi-Channel Fulfillment (MCF), which even supports non-Amazon sales channels (like a third-party website).

The benefits of FBA include lower per-unit shipping costs, increased exposure through the Prime badge, and operational efficiencies. Sellers can also expand globally through services like Remote Fulfillment with FBA and Amazon Export. Other tools like Amazon Global Logistics and Buy with Prime help streamline international operations and direct-to-consumer sales. FBA’s flexibility lets sellers enroll as many or as few products as they wish, with options to experiment and scale based on performance and budget.

Costs under FBA are usage-based, including fulfillment, storage, and aged-inventory fees, all of which vary depending on product size, type, and duration in storage. Tools like the FBA Revenue Calculator help sellers estimate profits and compare FBA to other fulfillment methods. The onboarding process involves setting up an Amazon seller account, enrolling products, labeling and prepping inventory, shipping goods to fulfillment centers, and tracking stock through Seller Central. Once established, sellers can focus more on product development and marketing, using FBA’s infrastructure to deliver consistent, fast, and reliable service that builds customer trust and drives business growth.

2. Fulfilled by Merchant (FBM)

Fulfilled by Merchant (FBM) allows sellers to manage their own inventory, packaging, and shipping rather than outsourcing fulfillment to Amazon. This offers flexibility and control, and enables sellers to fulfill orders directly from their own warehouses while using Amazon’s sales platform. FBM can be used as a standalone model or alongside Fulfillment by Amazon (FBA) in a hybrid approach, allowing sellers to tailor their logistics strategy depending on product type, cost structure, and business goals. This is useful for bulky, slow-moving, or temperature-sensitive products that may not be ideal for FBA storage.

FBM gives sellers the ability to set custom shipping rates, handling times, and delivery capacities, or use Amazon’s automation tools to optimize delivery dates for better conversion rates. Through programs like Amazon Buy Shipping and Veeqo, sellers can access discounted carrier rates and automate inventory management across multiple platforms, including Shopify, eBay, and Walmart. Once sellers meet certain performance standards, they can also qualify for Premium Shipping or Seller Fulfilled Prime, which enables Prime badge eligibility while maintaining in-house fulfillment.

The setup process for FBM involves registering a seller account, listing products, configuring shipping and returns, and managing inventory. Sellers must handle cancellations, returns, and customer service directly while monitoring performance through tools such as the Fulfillment Insights Dashboard and Account Health. With advanced options like Shipping Settings Automation, Multi-Location Inventory, and Veeqo integrations, FBM gives sellers the operational autonomy to fulfill orders quickly and accurately while maintaining brand control and customer satisfaction.

3. Private Label

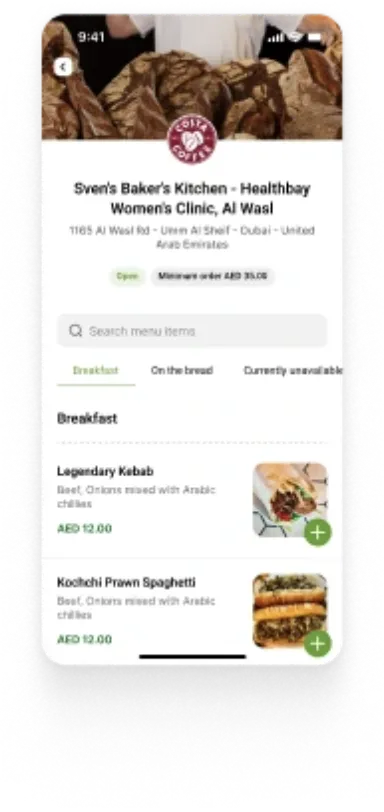

The private label model involves creating and selling products under a seller’s own brand, rather than reselling existing products from other manufacturers. In this model, sellers source generic or white-label products, often from suppliers on platforms such as Alibaba or local manufacturers, and label them with their own branding, packaging, and design. Once the brand identity is established, sellers register it through Amazon Brand Registry to gain protection, marketing advantages, and access to enhanced tools like A+ Content and Sponsored Brands. Private label is among the most popular models on Amazon, because it offers higher profit margins, greater control over pricing, and the potential to build a long-term brand asset rather than relying on short-term product arbitrage.

The process of launching a private label product typically follows a structured flow: researching market gaps, sourcing and sampling products, negotiating with suppliers, designing branding and packaging, and then listing the product on Amazon using optimized keywords, images, and descriptions. Once listed, sellers can choose between Fulfillment by Amazon (FBA) or Fulfilled by Merchant (FBM) to handle logistics. Success in private label selling depends heavily on product differentiation, review generation, and effective advertising. By focusing on branding and customer loyalty, private label sellers can move beyond competing on price and instead build a sustainable business that stands out in Amazon’s crowded marketplace.

4. Retail / Online Arbitrage

Retail and online arbitrage are business models where sellers buy discounted or clearance products from retail stores or online marketplaces and resell them on Amazon at a higher price for profit. Instead of developing their own brand or sourcing directly from manufacturers, arbitrage sellers take advantage of market inefficiencies, such as price differences between local stores and Amazon’s marketplace. Retail arbitrage involves physically purchasing products from brick-and-mortar stores like Walmart or Target, while online arbitrage uses e-commerce platforms to find and ship profitable inventory directly to the seller or Amazon’s fulfillment centers. This model requires minimal upfront investment and allows beginners to quickly start selling without long lead times.

The success of arbitrage depends on product research and compliance with Amazon’s rules, especially regarding restricted brands and product authenticity. Sellers use tools like Keepa and SellerAmp to analyze price history, sales rank, and potential profit margins. While retail and online arbitrage can generate consistent short-term income, they are less scalable compared to private label or wholesale models due to limited product availability and frequent competition for the Buy Box. Many sellers use this model as an entry point into Amazon selling to build experience, capital, and understanding of the marketplace before transitioning into more sustainable models like wholesale or private label.

5. Drop-shipping

Dropshipping on Amazon is a fulfillment model where sellers list and sell products without holding any inventory themselves. Instead, when a customer places an order, the seller purchases the item from a third-party supplier, who then ships the product directly to the customer. This allows the sellers to start with minimal upfront investment, as they do not need to buy or store inventory. However, Amazon’s dropshipping policy is strict: sellers must always be the “seller of record,” ensure that packing slips and invoices identify them (not the supplier), and take full responsibility for customer service and returns. Violating these conditions, such as shipping directly from another retailer, can result in account suspension.

While dropshipping minimizes inventory and storage risks, it also introduces challenges in quality control, delivery speed, and customer satisfaction. Profit margins tend to be lower, and maintaining reliable supplier relationships becomes crucial to avoid late shipments or stockouts. Successful dropshippers often integrate software tools for order automation, price monitoring, and inventory syncing to manage operations efficiently. Many sellers use dropshipping as a testing strategy to identify profitable products before transitioning to more controlled models like private label or FBA. When executed correctly within Amazon’s policies, dropshipping can serve as a low-risk entry point into e-commerce, though it requires strong management and attention to compliance.

Key Operational Considerations

Every successful business needs more than just good products. This section explores the operational considerations that help run such businesses smoothly, from inventory management to finance, and everything in between that could help a potential seller scale effectively.

1. Inventory Management

Effective inventory management is important for maintaining profitability and ensuring a smooth sales flow on Amazon. The first step is estimating demand accurately. This requires analyzing sales history, seasonality, and keyword trends to help forecast how much stock to order. Tools like Amazon’s Inventory Performance Dashboard and third-party analytics platforms can refine these estimates and prevent misjudgments.

A key metric to monitor is the inventory turnover rate, which measures how quickly the stock sells relative to the inventory levels. A healthy turnover rate means that the inventory is converting into sales without tying up excessive capital. However, poor balance can lead to two major risks: stock-outs, which result in lost sales and lower rankings, and overstocking, which increases holding costs and risks product obsolescence. Sellers must also be aware of Amazon’s storage and long-term inventory fees.

2. Sourcing & Buying Inventory

Choosing the right sourcing strategy is one of the most critical steps in building a profitable Amazon business. Sellers can source products domestically, from local manufacturers or wholesalers, for faster shipping, easier communication, and higher quality control. Alternatively, overseas sourcing, particularly from platforms like Alibaba or Global Sources, offers lower production costs and broader customization options, though it requires careful planning to manage longer lead times and potential import complexities.

Before committing to a supplier, it is essential to perform supplier verification and quality control. This includes reviewing certifications, checking references or reviews, requesting samples, and even arranging factory audits for large orders. These steps help ensure product consistency and reduce the risk of counterfeit or defective goods.

Sellers must also consider Minimum Order Quantities (MOQs), the smallest batch a supplier is willing to produce, which directly impacts startup costs and inventory risk. Finally, understanding your Cost of Goods Sold (COGS) and calculating margins accurately is vital. Include product cost, shipping, customs, and Amazon fees when evaluating profitability. Maintaining healthy margins ensures that even after advertising and fulfillment expenses, your business remains sustainable and competitive.

3. Storage & Fulfillment

Efficient storage and fulfillment operations are the backbone of a scalable Amazon business. Sellers typically choose between Fulfillment by Amazon (FBA) or self-storage options such as personal warehouses or third-party logistics providers (3PLs). FBA offers convenience, Prime eligibility, and Amazon-handled shipping and customer service, while self-fulfillment provides greater control, flexibility, and often lower costs for bulky or slow-moving items.

Proper packaging, labeling, and product preparation are essential for smooth operations, especially when using FBA. Amazon has strict requirements for barcodes (FNSKU), packaging materials, and labeling standards to ensure items are safely stored and quickly identifiable. Failing to comply can result in delays, added fees, or even inventory rejection.

When sending goods to Amazon, sellers must follow specific shipping procedures to fulfillment centers, including creating shipment plans, printing labels, and selecting approved carriers. Finally, returns handling and restocking play a critical role in customer satisfaction. With FBA, Amazon manages returns automatically; with self-fulfillment, sellers must process returns manually, inspecting, restocking, or disposing of items as needed to maintain inventory accuracy and protect profit margins.

4. Sales & Marketing

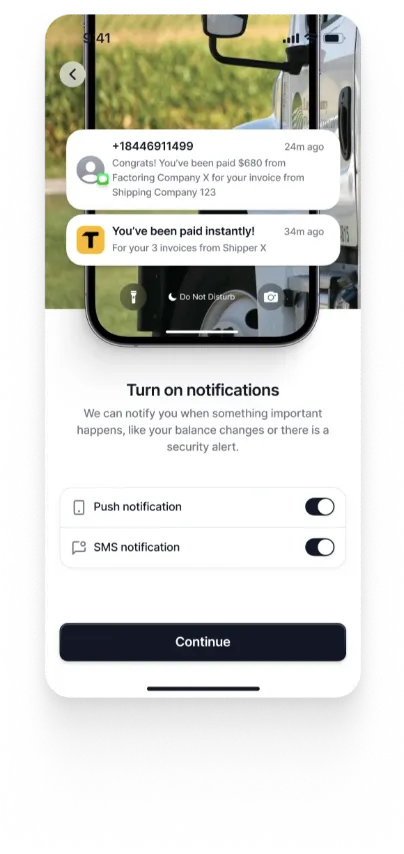

Driving sales on Amazon requires strategic marketing and optimized product listings that attract clicks and convert visitors into buyers. The foundation lies in listing optimization, crafting compelling titles, high-quality images, and detailed bullet points enriched with relevant SEO keywords. Well-optimized listings not only improve visibility in Amazon’s search results but also help communicate value, build trust, and increase conversion rates.

Pricing strategies play a key role in competitiveness. Sellers often use dynamic pricing tools to adjust prices automatically based on demand, competition, and profitability goals. Striking the right balance between margin and volume ensures sustainable growth. To further boost visibility, Amazon PPC (Pay-Per-Click) ads allow sellers to sponsor products in search results and on competitor listings, helping generate traffic and sales momentum, especially for new listings.

Finally, promotions, coupons, and customer reviews are essential tools for building credibility and driving conversions. Limited-time discounts and coupons attract budget-conscious shoppers, while authentic, positive reviews strengthen trust and improve organic ranking. Managing reviews ethically and providing excellent post-purchase service can make a lasting impact on brand reputation and long-term success.

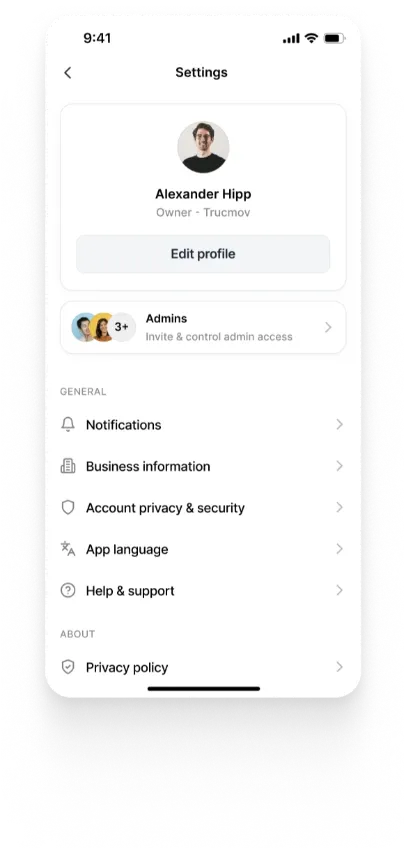

Financials & Fees

Understanding the financial side of selling on Amazon is essential for maintaining profitability and ensuring long-term growth. Sellers must first account for Amazon’s various fees, which typically include referral fees (a percentage of each sale), FBA fees for storage and fulfillment, and additional charges like closing fees or long-term storage costs. These fees can add up quickly, so tracking them closely is key to understanding true profit margins.

A thorough profit margin analysis helps sellers evaluate product viability and pricing strategy. This involves calculating the total cost of goods, shipping, and all Amazon-related expenses, then comparing it to the final selling price. Using Amazon’s revenue calculators or third-party tools can simplify this process and ensure accurate forecasting.

Sellers must also stay compliant with taxes, import duties, and accounting requirements. This includes understanding sales tax obligations in different regions, keeping records for audits, and accounting for international shipping duties where applicable. Lastly, strong cash flow management keeps the business running smoothly, balancing inventory purchases, ad spend, and payouts from Amazon to avoid liquidity issues while maintaining enough capital to scale operations effectively.

Risk Factors

While Amazon offers vast growth potential, it also presents a range of risks that can threaten profitability and long-term stability if not managed carefully. One of the most pressing challenges is competition and price wars.

1. Market Saturation

With thousands of active sellers and new entrants every day, the marketplace can quickly become saturated, especially for popular or trending products. To stay ahead, sellers must focus on differentiation, whether through branding, superior product quality, unique bundles, or exceptional customer experience. Relying solely on low pricing as a strategy often leads to shrinking margins and unsustainable operations.

2. Risk of Policy Violations

Equally critical is the risk of policy violations and account suspensions. Amazon maintains strict rules around listing accuracy, customer communication, and review management. Even unintentional mistakes, such as mislabeled items, misleading descriptions, or delayed shipments, can trigger warnings or suspensions. Competing sellers may also file false complaints to harm rivals. Recovering from a suspension can take weeks or months, so maintaining full compliance and thorough documentation is essential to safeguard your account.

3. Algorithmic Changes

Algorithm changes and advertising cost fluctuations pose additional challenges. Amazon’s ranking and ad systems evolve constantly, meaning what works one month might fail the next. Sellers dependent on Amazon PPC or organic rankings can see their visibility and sales plummet without warning. Staying adaptable, regularly testing ad strategies, optimizing listings, and diversifying traffic sources helps cushion against these shifts.

4. Operational Risks

Operational risks also play a significant role. Supply chain delays, defective products, or poor quality control can lead to late deliveries, negative reviews, and returns, all of which hurt seller performance metrics. Sellers who rely on overseas manufacturers are especially vulnerable to global shipping disruptions, customs delays, or production errors. Having backup suppliers, quality inspections, and realistic lead times can reduce this risk.

5. Amazon’s Payout Cycle Structure

Lastly, many sellers underestimate the financial strain caused by Amazon’s payout cycle and cash flow management. Since funds are typically released every 14 days, and only after deducting fees and refunds, sellers may struggle to restock inventory or scale advertising in time. This creates a “cash flow squeeze,” particularly during high-demand seasons. To mitigate it, sellers should maintain reserve capital, track expenses closely, and consider short-term financing solutions to keep inventory and operations running smoothly. In short, understanding and preparing for these risks is key to building a resilient, long-term Amazon business.

KPIs (Key Performance Indicators)

Tracking Key Performance Indicators (KPIs) is essential for measuring the health and growth of an Amazon business. These metrics provide insight into how efficiently operations are running, how effectively marketing strategies are performing, and how well customer expectations are being met. By consistently monitoring and analyzing KPIs, sellers can make data-driven decisions that improve performance and profitability over time.

The most fundamental metrics are sales volume and revenue, which reflect overall business growth and market demand. However, focusing solely on top-line numbers can be misleading; sellers must also monitor their conversion rate, the percentage of visitors who make a purchase. A strong conversion rate typically signals effective listings, competitive pricing, and trust-building factors like reviews and fast delivery.

Profitability-focused KPIs include ROI (Return on Investment) and profit margin, which measure how efficiently a seller turns investment, whether in inventory, advertising, or logistics, into profit. These indicators help identify which products or campaigns are worth scaling and which may need optimization or discontinuation.

Operationally, inventory turnover measures how quickly stock is sold and replenished, balancing storage costs against sales speed. High turnover suggests strong demand and efficient inventory management, while low turnover can indicate overstocking or weak product appeal. Finally, customer rating and review count are critical to Amazon’s ecosystem; they directly affect visibility, conversion rates, and long-term brand trust. Maintaining high ratings through excellent service, quality control, and responsive communication is one of the strongest predictors of sustainable success on Amazon.

Conclusion

E-commerce through Amazon provides immense opportunities for entrepreneurs to build profitable and scalable businesses in the global digital market. Success depends on choosing the right model, whether FBA, FBM, private label, arbitrage, or dropshipping, and mastering key operational areas such as sourcing, fulfillment, marketing, and financial management. While competition, policy risks, and cash flow challenges remain significant, sellers who focus on differentiation, efficient operations, and strong customer service can achieve sustainable growth. By continuously monitoring performance metrics and adapting to market changes, businesses can leverage Amazon’s vast infrastructure to establish long-term success and brand value.

Authors

References

“Amazon FBA for Beginners.” Amazon Selling Partner Blog, 1 Apr. 2023, sell.amazon.com/blog/amazon-fba-for-beginners.

“Amazon FBM (Fulfilled by Merchant).” Sell on Amazon, sell.amazon.com/programs/fulfilled-by-merchant.

“Amazon Percent of Units by Third-Party Sellers 2004-2022.” Marketplace Pulse, www.marketplacepulse.com/stats/amazon-percent-of-units-by-third-party-sellers.

“FBA Private Label Brand Name.” Amazon.com, 13 Jan. 2025, sellercentral.amazon.com/seller-forums/discussions/t/a1b49a19-fe73-46cd-b808-8706fc6664d6. Accessed 22 Oct. 2025.

“Sponsored Products – Promote Listings with CPC Ads.” Amazon Advertising, advertising.amazon.com/solutions/products/sponsored-products.