PCI Compliance in AI-driven Payment Systems

Summary

As AI transforms payments, it introduces compliance risks often overlooked in PCI DSS frameworks. This insight explores how AI models can leak data, bypass access controls, or create audit blind spots, and outlines best practices to align AI adoption with security standards. With PCI DSS v4.0.1 now covering AI systems, proactive governance is critical to protect cardholder data.

Key insights:

AI Models Can Leak Data: Poorly trained models may memorize and expose cardholder data, violating PCI DSS.

Shadow AI Is a Major Threat: Unapproved AI tool use by employees can create audit gaps and security breaches.

AI Lacks Audit Transparency: Many AI systems don’t produce traceable logs, hindering PCI validation.

Third-party AI Use Is Risky: Consumer-grade tools lack enterprise-level compliance guarantees.

AI Expands PCI Scope: PCI DSS v4.0.1 explicitly includes AI systems impacting cardholder data security.

Training & Governance Are Essential: Lack of staff awareness leads to accidental violations via AI misuse.

Introduction

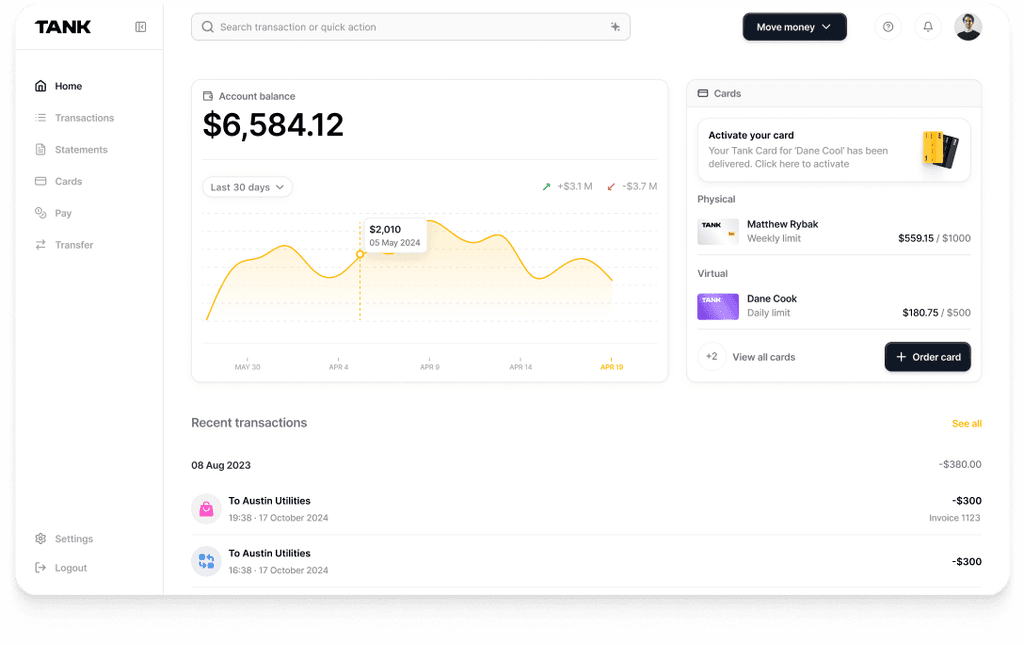

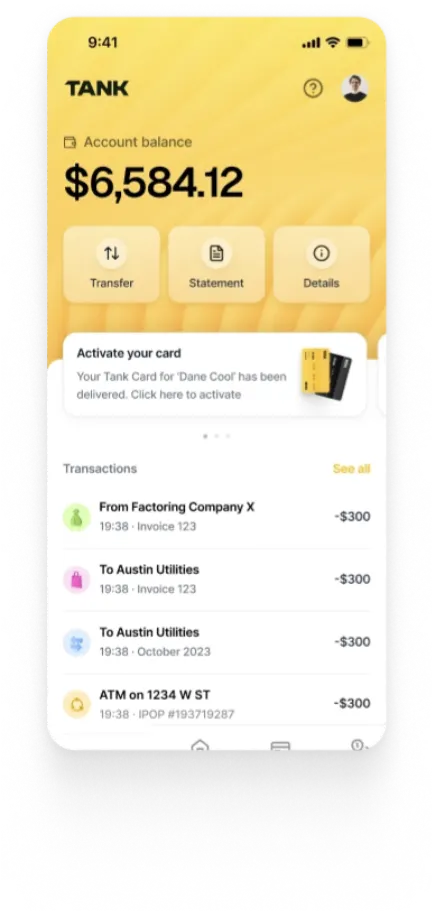

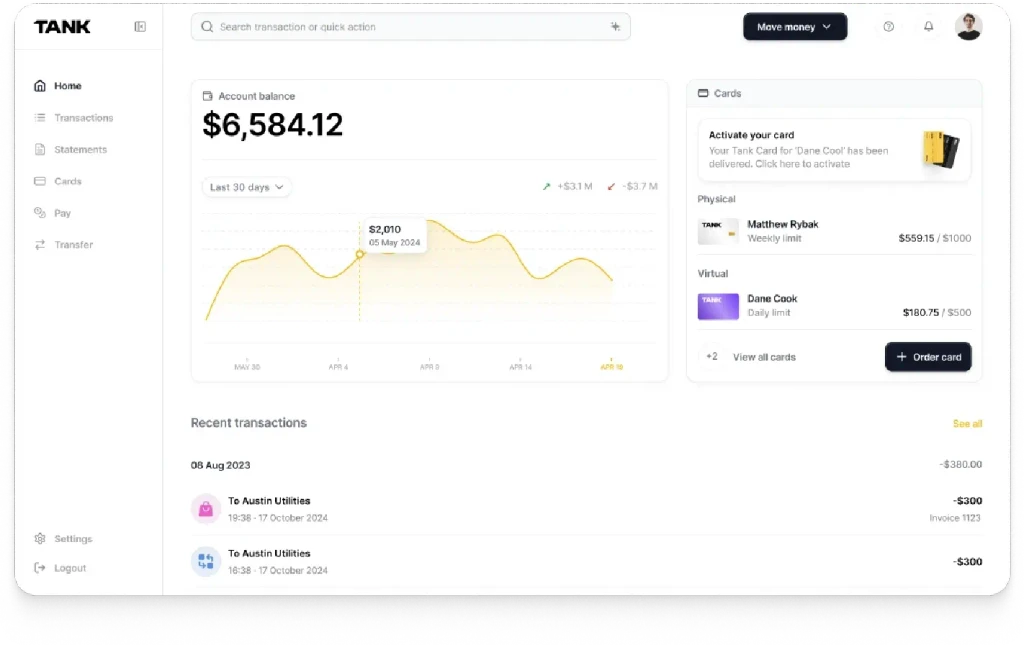

Artificial Intelligence is rapidly transforming the payment ecosystem, powering everything from real-time fraud detection to intelligent transaction routing and personalized user experiences. As financial institutions and fintech platforms embrace AI to enhance speed, security, and efficiency, they are also entering complex regulatory territory. One key area impacted is PCI DSS (Payment Card Industry Data Security Standard) compliance, which governs how organizations handle and protect cardholder data.

This insight examines the growing intersection between AI and PCI DSS, uncovering the hidden compliance risks introduced by intelligent systems and offering practical strategies to ensure secure, standards-aligned innovation in modern payment environments.

Context & Background

The Payment Card Industry Data Security Standard (PCI DSS) is a globally recognized framework designed to protect cardholder data and ensure the secure handling of credit and debit card transactions. Developed by the PCI Security Standards Council, it outlines technical and operational requirements that organizations must follow to safeguard sensitive payment information and maintain trust in the global payment ecosystem. Non-compliance can lead to hefty fines, legal action, and loss of merchant privileges.

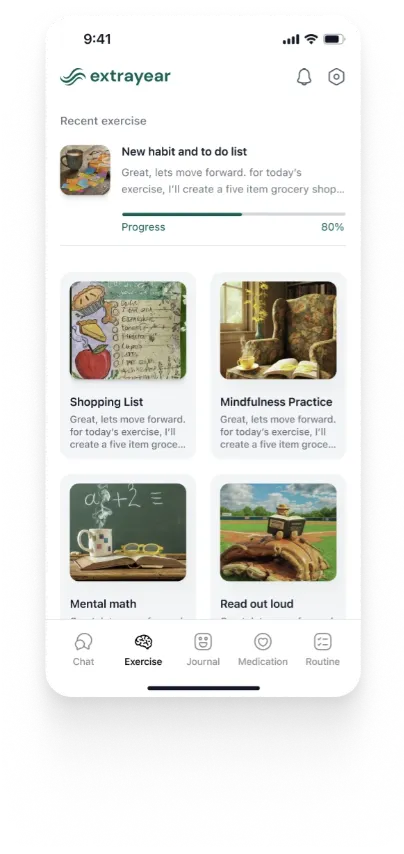

At the same time, Artificial Intelligence (AI) is becoming a core component of modern payment systems. AI is used to enhance fraud detection by analyzing behavioral patterns in real-time, optimize transaction routing for efficiency, detect anomalies, and deliver personalized user experiences based on spending history and preferences. These intelligent systems continuously learn from vast amounts of transactional data, enabling smarter and faster decision-making.

As organizations accelerate AI adoption to stay competitive, they now face a critical convergence point with PCI DSS compliance. AI introduces complex data flows, third-party integrations, and model behavior that may fall outside the scope of traditional security controls. Meanwhile, regulators are increasing scrutiny on AI's use in high-stakes environments, particularly those involving personal and financial data. This makes it more important than ever to ensure that AI systems are designed, trained, and deployed in ways that fully align with PCI requirements.

Compliance Challenges Introduced by AI

While AI unlocks powerful capabilities in payment systems, it also introduces new compliance risks that many organizations are unprepared to manage. These risks often fall outside traditional security frameworks, yet they directly impact PCI DSS scope, particularly under version 4.0.1, which includes any systems that could affect the security of cardholder data.

1. Model Leakage

AI models, especially those trained on sensitive transaction data, can inadvertently memorize and expose cardholder information. This risk is heightened when models are poorly designed or lack sufficient data sanitization during training. In some cases, inference queries could unintentionally cause a model to return fragments of the data it was trained on, including magnetic stripe data, PANs, or merchant identifiers, which are direct violations of PCI DSS.

2. Shadow AI Systems

One of the most dangerous trends is the rise of shadow AI, tools, and workflows adopted by employees outside of official governance. For example, a developer troubleshooting a payment error once pasted a transaction log (containing cardholder data) into a consumer version of ChatGPT, triggering a major PCI violation. These unsanctioned AI interactions often go unnoticed by security teams and leave no audit trail, exposing organizations to significant penalties.

3. Black-box Decision-Making

Many AI models operate as black boxes, making it difficult to explain how a fraud decision was made or how cardholder data was processed. This lack of transparency violates PCI DSS expectations around auditability and accountability. Without clear model documentation or visibility into AI data flows, organizations cannot produce evidence of secure data handling, a key requirement for PCI compliance assessments.

4. Third-party AI Tools and Vendors

Organizations frequently rely on third-party AI platforms to process or generate insights from payment data. While some enterprise AI solutions (e.g., OpenAI’s enterprise-grade ChatGPT, Google Gemini, Claude for Enterprise) maintain strong security certifications like PCI DSS, SOC 2, and ISO 27001, consumer-grade versions do not offer the same guarantees. Many employees unknowingly use these non-compliant tools, unintentionally transferring cardholder data outside the organization's controlled environment.

5. The Hidden Gap

According to a 2024 Ponemon Institute survey, 92% of Qualified Security Assessors (QSAs) now classify AI tools interacting with cardholder systems as in-scope for PCI assessments. Yet Gartner reports that 80% of enterprises will adopt generative AI by 2026, and most are still unaware of the full compliance implications. This growing gap between usage and governance is a ticking time bomb.

How AI Affects Key PCI DSS Requirements

As AI becomes deeply embedded in payment environments, it directly impacts several core PCI DSS requirements. The standard’s latest version (4.0.1) explicitly brings into scope any systems, including AI platforms, that could affect the security of the cardholder data environment (CDE). Below is a breakdown of how specific PCI DSS controls are affected by the use of AI in payment systems:

1. Protect Stored Cardholder Data

AI models often require large datasets for training. If these datasets contain raw or insufficiently anonymized cardholder data, such as full PANs, CVVs, or magnetic stripe data, they violate this requirement. Worse, if these datasets are used in third-party platforms (e.g., commercial AI APIs or cloud services), the data may leave your organization’s control and become untraceable.

AI Risks: The use of real cardholder data for training or prompt engineering poses a significant compliance risk, as it can lead to the inadvertent storage of sensitive information within model memory, commonly known as model leakage. When training datasets lack proper encryption, tokenization, or redaction, the potential for exposing cardholder data increases, making the AI system non-compliant with PCI DSS requirements and vulnerable to breaches.

Compliance Tip: Use synthetic or tokenized data, enforce encryption at rest, and prevent model exposure of original inputs.

2. Develop and Maintain Secure Systems and Applications

AI models are part of the system lifecycle and must follow secure development practices. This includes ensuring that models are regularly updated, tested for vulnerabilities, and patched if they depend on libraries or frameworks with known flaws.

AI Risks: Using outdated or vulnerable machine learning frameworks can expose AI systems to known security flaws, increasing the risk of exploitation. This risk is compounded by a lack of secure coding practices within model pipelines or APIs, which may introduce additional vulnerabilities during development or deployment. Without a defined AI-specific development lifecycle or patching process, organizations struggle to identify, prioritize, and remediate security issues, leaving compliance gaps and weakening the overall security posture.

Compliance Tip: Treat AI models and pipelines as applications. Incorporate threat modeling, static analysis, and patch management into your AI development workflow.

3. Restrict Access to Cardholder Data + Assign Unique IDs

AI systems often operate on privileged backend infrastructure. If proper access controls aren't in place, unauthorized users (including internal developers or third-party integrators) could access sensitive data, training logs, or model outputs.

AI Risks: Inadequate role-based access control to AI infrastructure can allow unauthorized individuals to interact with sensitive systems, increasing the risk of data exposure and non-compliance. The use of shared credentials or publicly accessible model endpoints further undermines accountability, making it difficult to enforce access restrictions or trace actions back to specific users. Additionally, the absence of user-specific access logs for AI interactions creates blind spots in auditability, preventing organizations from demonstrating control over who accessed what data, when, and why, key requirements under PCI DSS.

Compliance Tip: Apply strict role-based access control (RBAC) to AI systems, ensure MFA for admin-level access, and assign unique IDs to all users interacting with AI models that touch regulated data.

4. Track and Monitor All Access to Network Resources and Cardholder Data

AI platforms, especially cloud-based ones, often lack sufficient logging and monitoring. Consumer versions of tools like ChatGPT or Claude do not produce audit logs needed for PCI DSS validation. If sensitive data flows through these tools without traceability, compliance is instantly compromised.

AI Risks: The absence of an audit trail for prompts or data processing significantly hampers an organization’s ability to demonstrate compliance and investigate incidents involving AI systems. Without integration with SIEM solutions or centralized logging mechanisms, AI activity remains siloed and unmonitored, creating critical visibility gaps. This challenge is further exacerbated by shadow AI, unsanctioned use of AI tools by employees, which often occurs without IT oversight, making it nearly impossible to track data flow, enforce policies, or maintain accountability across the cardholder data environment.

Compliance Tip: Use enterprise AI tools with audit logging capabilities, integrate AI usage logs with your SIEM, and monitor all data flows in and out of AI systems.

5. Regularly Test Security Systems and Processes

AI systems must be tested just like any other component in the payment infrastructure. This includes vulnerability assessments, penetration testing of APIs/models, and red team evaluations of how AI could be misused or manipulated.

AI Risks: When AI endpoints are excluded from regular penetration testing, they become overlooked attack surfaces within the payment infrastructure. Unscanned AI model APIs may inadvertently expose cardholder data, especially if they handle sensitive inputs without proper validation or security controls. Furthermore, the lack of fuzzing or adversarial testing against AI inputs and outputs leaves these systems vulnerable to exploitation through unexpected queries or manipulations, potentially leading to data leakage, unauthorized access, or model misbehavior, violating key PCI DSS security and testing requirements.

Compliance Tip: Include AI pipelines in your quarterly vulnerability scans and annual penetration tests. Regularly simulate AI abuse scenarios (e.g., prompt injections, model extraction).

Risk Mitigation & Best Practices

To align AI adoption with PCI DSS requirements, organizations must proactively integrate governance, oversight, and control mechanisms into every phase of their AI lifecycle. The following best practices help reduce compliance risk and ensure AI tools support security, not compromise it.

1. Use Tokenized or Synthetic Data for Training

AI models should never be trained on real cardholder data unless it's been properly masked, tokenized, or anonymized. Synthetic data that mimics real-world patterns without containing actual PANs or transaction identifiers provides a safe and effective alternative.

Why it matters: Training models on raw or insufficiently protected data risks model leakage and storage violations under PCI DSS Requirement 3.

Best Practice: To mitigate compliance risks, organizations should use tokenization for any production-derived datasets to ensure that real cardholder data is never exposed during AI training. For development and experimentation, synthetic datasets should be generated to simulate real-world patterns without containing actual sensitive information. Additionally, enforcing pre-submission scanning for sensitive data before model training helps catch and prevent unintentional inclusion of cardholder data, ensuring adherence to PCI DSS requirements from the outset.

2. Classify AI Models as PCI-In-Scope Components

Any AI model that processes, stores, or influences decisions related to cardholder data must be classified as in-scope for PCI assessments. This includes fraud detection models, transaction scoring systems, and AI-based monitoring tools.

Why it matters: PCI DSS 4.0.1 considers any system that could impact the security of the CDE as in-scope, including AI infrastructure and outputs.

Best Practice: AI models should be treated like any other in-scope system under PCI DSS, with full application of relevant security and compliance controls. This includes managing AI storage, access permissions, version control, and patching processes to ensure they meet the same standards as traditional components in the cardholder data environment. Where appropriate, organizations should also explore scope reduction strategies, such as data segmentation or isolating AI functions, to limit the compliance footprint and reduce risk exposure.

3. Document All AI Data Flows and Interactions

Opaque data flows are a major compliance risk. AI pipelines must be fully documented to demonstrate how data is collected, transformed, processed, stored, and accessed.

Why it matters: AI systems that cannot demonstrate traceability or provide visibility into their operation will fail audit requirements for transparency, logging, and evidence gathering (Requirements 10 & 12).

Best Practice: Organizations should create comprehensive end-to-end data flow diagrams that clearly illustrate how data moves through AI systems, from ingestion to output. Alongside these diagrams, maintaining detailed documentation of datasets, model inputs and outputs, storage locations, and all access events is essential for ensuring transparency and audit readiness. To remain compliant with evolving PCI DSS requirements and system changes, this documentation must be regularly reviewed and updated to reflect any modifications in data handling or infrastructure.

4. Log and Monitor AI Model Access

Access to AI models, especially those trained on sensitive data, must be logged, monitored, and restricted. This includes API calls, configuration changes, and query-based interactions.

Why it matters: Unmonitored AI access creates blind spots in compliance. PCI DSS Requirement 10 mandates full audit trails of all access to cardholder systems and data.

Best Practice: To ensure visibility and accountability, organizations should integrate AI tools with their existing SIEM solutions, enabling centralized monitoring of all AI-related activity. Tamper-resistant logs must be maintained for key operations, including model training, inference, and access events, to support compliance audits and forensic investigations. Additionally, real-time alerts should be configured to detect suspicious behavior or anomalies in data access, allowing security teams to respond swiftly to potential threats and maintain PCI DSS alignment.

5. Train Staff on AI-Specific Compliance Concerns

Many violations occur not because of malicious intent, but due to untrained employees using AI tools like ChatGPT or Claude without understanding the risks. PCI compliance now requires that personnel understand how AI use impacts cardholder data security.

Why it matters: Shadow AI, poor judgment in prompt engineering, and use of consumer-grade AI platforms are leading causes of unintentional violations.

Best Practice: Organizations should establish clear, enforceable policies that define acceptable AI usage, particularly when handling or interacting with payment data. Regular training sessions should be conducted to educate employees on the risks of sharing sensitive information with AI tools and the potential compliance consequences. It's also critical to ensure that all staff understand the distinction between consumer-grade AI platforms, which lack necessary security guarantees, and enterprise-grade solutions designed with compliance in mind, reducing the likelihood of accidental data exposure through unsanctioned tools

A Note on AI in PCI Assessments

AI can enhance PCI assessments by processing logs, summarizing documents, and organizing evidence, but it cannot replace human assessors. AI must not make compliance decisions, interpret nuanced requirements, or authorize final reports. All AI-generated insights must undergo rigorous QA and human validation, ensuring integrity in both assessments and day-to-day compliance workflows.

Conclusion

As AI continues to reshape the payment landscape, it is no longer optional for organizations to treat AI systems as part of their PCI DSS compliance scope, it is essential. From fraud detection engines to customer-facing chatbots, AI interacts with sensitive cardholder data in ways that traditional security frameworks may overlook. Without proper controls, documentation, and oversight, these systems can introduce hidden risks that compromise both security and regulatory standing.

Proactively integrating compliance into the AI lifecycle allows organizations to unlock the full benefits of AI, speed, accuracy, and scalability, without sacrificing data protection. By classifying AI components as in-scope, enforcing proper access controls, monitoring data flows, and training personnel on responsible AI use, businesses can maintain audit readiness and avoid costly violations.

Ultimately, innovation and compliance are not in opposition. When approached thoughtfully, they reinforce each other, enabling organizations to build secure, trustworthy, and future-ready payment systems that meet the demands of a rapidly evolving digital economy.

Authors

Engineer Compliance-First AI

Walturn builds secure, PCI-aligned AI systems with robust data controls, auditability, and custom development in Flutter and beyond.

References

Integrating Artificial Intelligence in PCI Assessments. docs-prv.pcisecuritystandards.org/Programs%20and%20Certification/Supporting%20Document/Integrating_Artificial_Intelligence_in_PCI_Assessments_Guidelines.pdf.

PCI Security Standards Council. PCI DSS Quick Reference Guide Understanding the Payment Card Industry Data Security Standard Version 3.2.1 for Merchants and Other Entities Involved in Payment Card Processing. July 2018, listings.pcisecuritystandards.org/documents/PCI_DSS-QRG-v3_2_1.pdf.

Rane, Satya. “What Are the 12 Requirements of PCI DSS Compliance?” ControlCase, 2025, www.controlcase.com/what-are-the-12-requirements-of-pci-dss-compliance/.

Welsh, Trevor. “Invisible Risk: How AI Use Creates PCI DSS Violations Today.” WitnessAI, 30 Apr. 2025, witness.ai/blog/blog-invisible-risk-how-ai-use-creates-pci-dss-violations-today/.